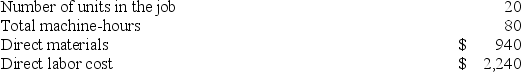

Cull Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $462,000, variable manufacturing overhead of $2.20 per machine-hour, and 60,000 machine-hours. The company has provided the following data concerning Job X455 which was recently completed:  The total job cost for Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

The total job cost for Job X455 is closest to: (Round your intermediate calculations to 2 decimal places.)

Definitions:

Present Value Analysis

A method of valuing a future cash flow to determine its worth at the present time, taking into account the time value of money.

Capital Investment

Money expended by a business to purchase or improve tangible assets like land, factories, or machinery.

Investment Funds

These are pooled funds from various investors used to acquire securities and other investment assets, managed by financial professionals.

Present Value Index

An index computed by dividing the total present value of the net cash flow to be received from a proposed capital investment by the amount to be invested.

Q21: Wyrich Corporation has two divisions: Blue Division

Q25: Dehner Corporation uses a job-order costing system

Q59: Kostelnik Corporation uses a job-order costing system

Q65: Rushenberg Corporation's operating leverage is 10.8. If

Q78: Chang Corporation has two divisions, T and

Q92: The fact that one department may be

Q95: Halbur Corporation has two manufacturing departments--Machining and

Q175: Pavelko Corporation has provided the following data

Q214: Kostelnik Corporation uses a job-order costing system

Q230: Kalp Corporation has two production departments, Machining