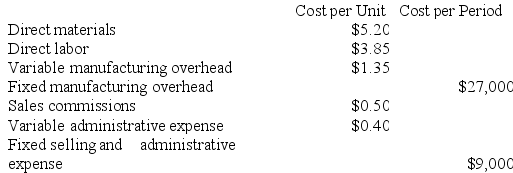

Learned Corporation has provided the following information:

Required:

Required:

a. For financial reporting purposes, what is the total amount of product costs incurred to make 6,000 units?

b. For financial reporting purposes, what is the total amount of period costs incurred to sell 6,000 units?

c. If the selling price is $22.40 per unit, what is the contribution margin per unit sold?

d. If 7,000 units are produced, what is the total amount of direct manufacturing cost incurred?

e. If 7,000 units are produced, what is the total amount of indirect manufacturing costs incurred?

Definitions:

Collection Bottle

A receptacle used for collecting and storing fluids or samples in medical settings.

Gastric Secretions

Fluids produced by the stomach, including hydrochloric acid and digestive enzymes, that aid in food digestion.

Coffee-Ground Secretions

Vomited material that resembles coffee grounds due to the presence of coagulated blood, often indicating bleeding in the gastrointestinal tract.

Culture Tube

A cylindrical container used in laboratories to grow and maintain microorganisms or cell cultures under controlled conditions.

Q6: Hinger Corporation is considering a capital budgeting

Q40: The Parts Division of Nydron Corporation makes

Q48: Bartoletti Fabrication Corporation has a standard cost

Q52: Pedregon Corporation has provided the following information:

Q52: Vaden Incorporated makes a single product-a critical

Q63: Chojnowski Incorporated makes a single product-a cooling

Q134: Prudencio Corporation has provided the following information

Q195: Rhome Corporation's relevant range of activity is

Q251: Schwiesow Corporation has provided the following information:

Q265: The University Store, Inc. is the major