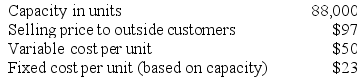

Vandermeer Products, Inc., has a Antennae Division that manufactures and sells a number of products, including a standard antennae. Data concerning that antennae appear below:

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

The company has a Aircraft Products Division that could use this antennae in one of its products. The Aircraft Products Division is currently purchasing 11,000 of these antennaes per year from an overseas supplier at a cost of $88 per antennae.

Required:

a. Assume that the Antennae Division is selling all of the antennaes it can produce to outside customers. What is the acceptable range, if any, for the transfer price between the two divisions?

b. Assume again that the Antennae Division is selling all of the antennaes it can produce to outside customers. Also assume that $1 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What is the acceptable range, if any, for the transfer price between the two divisions?

Definitions:

Revolutionary Technology

Refers to groundbreaking innovations that significantly alter and improve the way tasks or operations are conducted.

Long-Term Purpose

An overarching goal or objective that guides actions and decisions over an extended period.

Polices And Guidelines

Established rules and recommendations that govern behavior or operations within an organization, ensuring consistency and compliance.

Long-Term Purpose

The overarching goal or mission that guides an individual's or organization's actions over an extended period.

Q5: Cogdill Corporation manufactures numerous products, one of

Q40: Mancine Corporation has provided the following contribution

Q54: Wyler Logistic Solutions Corporation has developed a

Q61: Bourland Corporation is considering a capital budgeting

Q74: Tavis Robotics Corporation has developed a new

Q85: In the absorption approach to cost-plus pricing,

Q119: Mary Tappin, an assistant Vice President at

Q144: A decrease in production will ordinarily result

Q146: Marvel Corporation estimates that the following costs

Q168: Management of Plascencia Corporation is considering whether