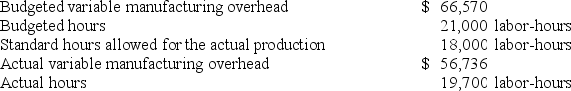

Figures Incorporated makes a single product-an electrical motor used in many long-haul trucks. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:  The variable overhead efficiency variance is:

The variable overhead efficiency variance is:

Definitions:

Activity-Based Costing

A method in cost accounting that assigns costs to products and services based on the activities involved in their production or delivery.

Activity Rates

Rates used in activity-based costing to assign overhead costs to products or services, based on the activities that drive those costs.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing more accurate cost information.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to specific activities, providing detailed information on where and how costs are incurred.

Q20: Which of the following costs could contain

Q28: Olivier Industries Inc. has developed a new

Q49: An income statement for Sam's Bookstore for

Q65: Bratton Corporation has provided the following information

Q66: Birkland Incorporated makes a single product--a critical

Q77: Division A makes a part with the

Q83: Division S of Kracker Company makes a

Q90: Two of the decentralized divisions of Gamberi

Q196: At an activity level of 9,000 machine-hours

Q253: Glew Corporation has provided the following information: