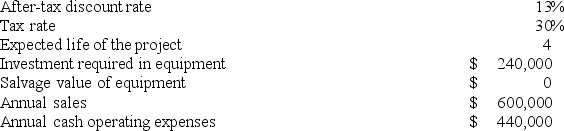

Truskowski Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $60,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

Definitions:

Consumption Function

An economic formula representing the relationship between total consumption and gross national income, indicating how changes in income affect spending.

Saving

The portion of income not spent on current expenditures or consumption, often put aside for future use or investment.

Disposable Income

The amount of money a household has available for spending and saving after income taxes have been accounted for.

Consumption Function

A macroeconomic concept that describes the relationship between total consumption and gross national income.

Q10: The present value of an amount to

Q21: Streif Inc., a local retailer, has provided

Q24: Hykes Corporation's manufacturing overhead includes $4.40 per

Q49: Tremble Corporation manufactures and sells one product.

Q59: Schackow Corporation is conducting a time-driven activity-based

Q64: Learned Corporation has provided the following information:<br>

Q85: Callum Corporation is conducting a time-driven activity-based

Q119: Fredin Incorporated makes a single product-an electrical

Q138: Layer Corporation has provided the following information

Q155: Lambeth Corporation has provided the following information: