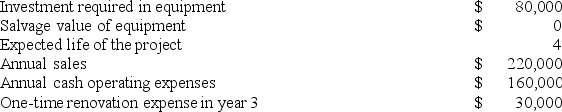

Marasco Corporation has provided the following information concerning a capital budgeting project:  The income tax rate is 30%. The after-tax discount rate is 13%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax rate is 30%. The after-tax discount rate is 13%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

Definitions:

Gastric Lipase

Gastric lipase is an enzyme secreted by the stomach that plays a crucial role in digesting dietary fats by breaking down triglycerides into monoglycerides and free fatty acids.

HCl

Hydrochloric acid, a strong acidic compound found in gastric juice that aids in digestion and kills bacteria.

Fundus

The upper part of the stomach, which creates a reservoir for undigested food and gas produced during digestion.

Pyloric

Pertaining to the region of the stomach that connects to the duodenum, involved in the regulation of gastric emptying.

Q22: Kisler Incorporated makes a single product-a cooling

Q26: Edlow Incorporated makes a single product--a critical

Q28: Gremminger Incorporated makes a single product-a critical

Q34: Salem Corporation is conducting a time-driven activity-based

Q63: Ohanlon Corporation manufactures numerous products, one of

Q78: Saxbury Corporation's relevant range of activity is

Q85: Whenever the selling division must give up

Q122: Dori Castings is a job order shop

Q128: Gaters Incorporated makes a single product--an electrical

Q156: Ronda Manufacturing Corporation uses a standard cost