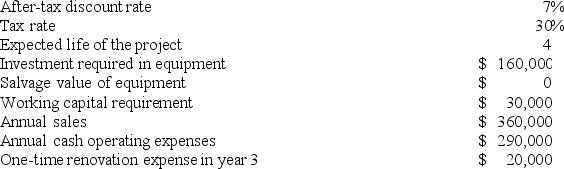

Houze Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

Definitions:

Dividend Growth Model

The dividend growth model is a valuation method used to estimate the price of a company's stock based on the assumption that dividends will increase at a steady rate indefinitely.

Rate of Growth

The percentage growth in the magnitude or worth of an item during a particular timeframe.

Required Rate of Return

The lowest annual yield necessary to draw individuals or firms towards investing in a specific venture or financial proposition.

Cumulative Voting

A voting system that allows shareholders to allocate all their votes to one candidate or distribute them among several candidates when electing directors.

Q1: The present value of a cash flow

Q11: Shanks Corporation is considering a capital budgeting

Q17: The following data pertains to activity and

Q20: Drucker Corporation manufactures and sells one product.

Q23: Gretter Corporation has two operating divisions--an Atlantic

Q42: In a Capacity Analysis report in time-based

Q43: Yashinski Corporation manufactures numerous products, one of

Q49: The target costing approach was developed in

Q108: A manufacturer of playground equipment has a

Q219: At an activity level of 9,000 machine-hours