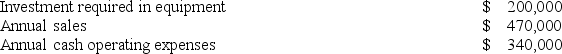

Chene Corporation has provided the following information concerning a capital budgeting project:  The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The equipment will have a 4 year expected life and zero salvage value. The company's income tax rate is 30%, and the after-tax discount rate is 10%. The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the project is closest to:

Definitions:

Functions

The natural purpose or activities associated with a person, organ, or system in biology, or a specific role or activity in more general contexts.

Birdsong

Vocalized sounds produced by birds, which can serve various functions including communication and mating.

Brain Areas

Distinct sections of the brain dedicated to specific functions, such as the occipital lobe for vision or the temporal lobe for hearing and memory.

Q13: Schwiesow Corporation has provided the following information:

Q23: Arca Incorporated makes a single product-a critical

Q25: Rhoads Corporation is considering a capital budgeting

Q34: The management of Featheringham Corporation would like

Q38: Income taxes have no effect on whether

Q40: Boynes Corporation is considering a capital budgeting

Q45: Code Corporation is conducting a time-driven activity-based

Q62: The investment in working capital at the

Q62: Imbesi Corporation is conducting a time-driven activity-based

Q93: The manufacturing overhead variance that is a