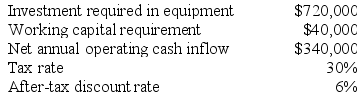

Padmore Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $240,000 per year. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting. The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project. Show your work!

Definitions:

Insurer

An entity that provides insurance policies to individuals or organizations, offering protection against financial loss from specified risks.

Insurance Coverage

Protection provided by an insurance policy against financial losses from specific risks or events.

Contract

A contract that is enforceable by law, detailing the responsibilities and rights among two or more entities.

Statutes

Statutes are laws that have been enacted by a legislative body, such as a parliament or congress.

Q15: A company has a standard cost system

Q21: Tremble Corporation manufactures and sells one product.

Q35: Valcarcel Corporation manufactures and sells one product.

Q43: Sulema, Inc. repairs and refinishes antique furniture.

Q51: Olis Corporation is considering a capital budgeting

Q87: Schlaefer Corporation is conducting a time-driven activity-based

Q102: Prudencio Corporation has provided the following information

Q105: Villella Corporation is conducting a time-driven activity-based

Q121: Jahnel Corporation is conducting a time-driven activity-based

Q127: Antinoro Corporation has provided the following information