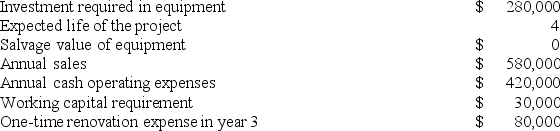

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

Definitions:

Ringworm

A fungal infection of the skin, characterized by a red, circular rash with clearer skin in the center, causing itching and discomfort.

Lunula

The white, half-moon-shaped area at the base of a nail.

Keratinocytes

Cells that make up the majority of the epidermis, the outermost layer of the skin, producing keratin, a protective protein.

Subcutaneous Layer

The layer of tissue directly under the skin, which contains fat and connective tissues and serves as a padding and insulation for the body.

Q5: Jarvis Corporation is conducting a time-driven activity-based

Q6: Buzby Corporation manufactures numerous products, one of

Q26: The management of Garn Corporation would like

Q27: Companies that use value-based pricing establish selling

Q31: Fregozo Products, Inc., has a Connector Division

Q61: Ahart Products, Inc., has a Transmitter Division

Q89: Mosburg Corporation is conducting a time-driven activity-based

Q94: Division A of Tripper Company produces a

Q102: Oberley Products, Inc., has a Receiver Division

Q144: Chojnowski Incorporated makes a single product-a cooling