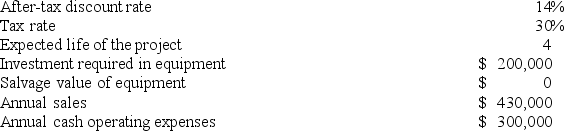

Rollans Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Expenditures

Money spent or costs incurred in an organization's efforts to generate revenue.

Farmer

An individual engaged in the practice of agriculture, raising living organisms for food or raw materials.

Percentage-Of-Completion Method

An accounting technique used in long-term contracts, recognizing revenue and expenses based on the project's estimated completion level.

Revenue

The total income generated from normal business operations and before any costs or expenses are deducted.

Q10: Depreciation expense is not included in the

Q12: Wollan Corporation has two operating divisions--an East

Q14: Mclellan Corporation applies manufacturing overhead to products

Q21: If the lowest acceptable transfer price from

Q26: Starcic Products, Inc., has a Connector Division

Q32: Jahnel Corporation is conducting a time-driven activity-based

Q33: Management of Thebeau, Inc., is considering a

Q40: If the formula for the markup percentage

Q87: Stopyra Incorporated makes a single product-a cooling

Q131: At a sales volume of 38,000 units,