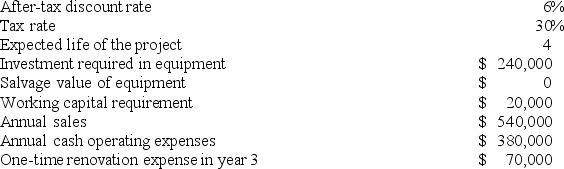

Vanzant Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

Endowments

Financial assets donated to institutions or individuals, often aimed at supporting ongoing funding needs.

Control Processes

Psychological mechanisms that help an individual regulate their thoughts, feelings, and behaviors in pursuit of their goals.

Total Immersion Approach

A method of language teaching where learners are placed in an environment where only the target language is spoken, to encourage rapid learning.

Bilingual Schooling

An educational approach where students are taught curriculum content in two languages, aiming to develop fluency and literacy in both.

Q3: Lemaire Corporation is conducting a time-driven activity-based

Q27: Companies that use value-based pricing establish selling

Q38: Plantier Incorporated makes a single product--a cooling

Q49: The target costing approach was developed in

Q63: Ganus Products, Inc., has a Relay Division

Q94: Wineman Incorporated makes a single product-an electrical

Q121: Patenaude Corporation has provided the following information

Q143: Wineman Incorporated makes a single product-an electrical

Q156: Ronda Manufacturing Corporation uses a standard cost

Q286: Lagle Corporation has provided the following information: