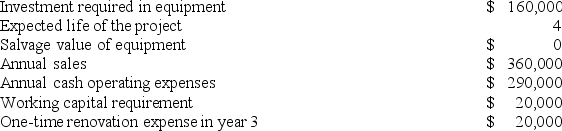

Layer Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

Definitions:

Disbursement Float

The time lag between when a payment is issued by a payer and when the funds are actually withdrawn from the payer's account.

Receivable Accounts

Balances of money due to a company for goods or services provided that have not yet been paid by customers.

Collection Time

The average period that a company takes to collect payments from its customers after a sale has been made, impacting cash flow and liquidity.

Processing Delay

The time lag between the initiation and completion of a process, often seen in transaction processing or manufacturing operations.

Q9: A company wants to have $40,000 at

Q34: The management of Featheringham Corporation would like

Q37: Marcelin Corporation manufactures and sells one product.

Q43: Sulema, Inc. repairs and refinishes antique furniture.

Q43: Taft Corporation is conducting a time-driven activity-based

Q47: Paparelli Corporation manufactures and sells one product.

Q48: Bartoletti Fabrication Corporation has a standard cost

Q114: In a Cost Analysis report in time-based

Q121: Trueba Electronics Corporation has developed a new

Q265: The University Store, Inc. is the major