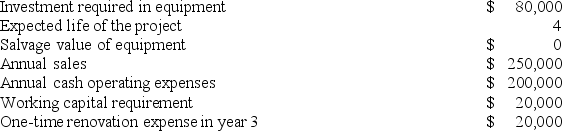

Mulford Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

Managerial Perceptions

The individual beliefs or understanding held by managers regarding various aspects of their organization, environment, or team, which can influence decision-making.

Financial Measures

Quantitative indicators used to assess the financial health and performance of a business or organization.

Leading Indicator

A measurable economic factor that changes before the economy starts to follow a particular pattern or trend, used to anticipate changes.

HRM Evaluation

The process of examining and assessing the effectiveness of Human Resource Management practices and policies in achieving organizational goals.

Q1: Mark is an engineer who has designed

Q4: Leslie Company operates a cafeteria for the

Q5: Mausser Woodworking Corporation produces fine cabinets. The

Q9: Prudencio Corporation has provided the following information

Q19: Buckbee Corporation manufactures and sells one product.

Q27: Rollans Corporation has provided the following information

Q36: Erkkila Inc. reports that at an activity

Q40: Spillett Corporation is conducting a time-driven activity-based

Q65: Morice Industries Inc. has developed a new

Q133: Chojnowski Incorporated makes a single product-a cooling