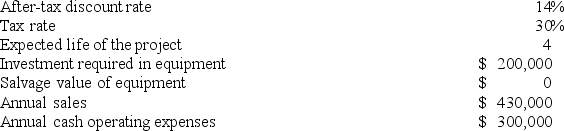

Rollans Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1, to determine the appropriate discount factor(s) using the tables provided.

The net present value of the entire project is closest to:

Definitions:

Direct Transfer

The movement of assets or funds from one type of account or investment vehicle directly to another without taking possession, often seen in IRA or 401(k) rollovers.

Share Certificates

Physical documents issued by a company that certify the holder is the owner of a specified number of shares in that company.

Sole Proprietorship

A business structure in which a single individual owns the company and is responsible for its debts and liabilities.

Double Taxation

A taxation principle referring to income taxes paid twice on the same source of earned income.

Q6: Njombe Corporation manufactures a variety of products.

Q9: Prudencio Corporation has provided the following information

Q14: Waltermire Corporation has provided the following information

Q29: Vandermeer Products, Inc., has a Antennae Division

Q44: Schubert Corporation manufactures and sells one product.

Q88: Wigelsworth Products, Inc., has a Sensor Division

Q94: Wineman Incorporated makes a single product-an electrical

Q97: A company needs an increase in working

Q110: Gauch Corporation is conducting a time-driven activity-based

Q145: Chasin Industries Inc. has developed a new