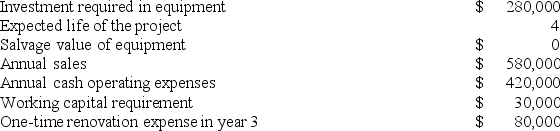

Stockinger Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 3 is:

Definitions:

Gain

The increase in value of an asset or decrease in liabilities resulting in an increase in owners' equity, except those relating to contributions from owners.

Fully Depreciated

The status of an asset whose entire cost has been expensed and has reached the end of its useful life according to accounting standards.

Gain on Disposal

The financial profit obtained from the sale of a fixed asset when the sale price exceeds the book value of the asset.

Loss on Disposal

This reflects the financial loss incurred when an asset is sold or disposed of for less than its recorded book value.

Q1: For performance evaluation purposes, variable service department

Q6: Azotea Corporation has two operating divisions--a Consumer

Q19: Lakeside Nursing Home has two operating departments,

Q25: The super-variable costing net operating income period

Q72: Fois Company has two divisions, Division X

Q72: Schwiesow Corporation has provided the following information:

Q105: Mercer Corporation estimates that an investment of

Q125: Condo Corporation has provided the following information

Q134: Schwiesow Corporation has provided the following information:

Q175: At a sales volume of 20,000 units,