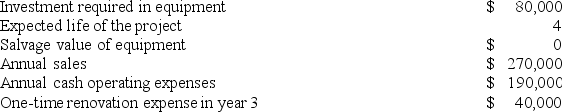

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

Platforms

Digital or physical spaces designed for various activities including social and economic exchanges.

Minimum Wage

The lowest legal salary that employers can pay workers, set by government regulations to ensure a basic standard of living for employees.

Cost Of Living

The average cost necessary to sustain a certain level of lifestyle in a given place, including expenses like housing, food, taxes, and healthcare.

Low Income

Refers to earning levels that are considerably lower than the national average, often resulting in financial constraints and limited access to resources.

Q1: Stubenrauch Corporation manufactures and sells one product.

Q1: Potestio Incorporated makes a single product-a critical

Q38: From the buying division's perspective, when a

Q42: Paletta Corporation has provided the following information

Q63: Cieslinski Corporation is conducting a time-driven activity-based

Q90: Vaden Incorporated makes a single product-a critical

Q91: Ricardo Products, Inc., has a Motor Division

Q128: Kingsford Pure Water Solutions Corporation has developed

Q151: Zotta Enterprises uses standard costing and applies

Q152: Mcgreal Incorporated has provided the following data