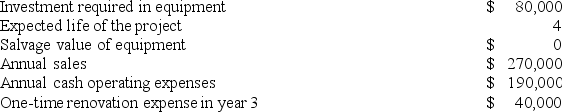

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The total cash flow net of income taxes in year 2 is:

Definitions:

Federal Reserve

The central banking system of the United States, responsible for implementing the country’s monetary policy and regulating its financial institutions.

Ceteris Paribus

A Latin phrase meaning "all other things being equal," used in economics to isolate the effect of one variable changing while holding others fixed.

Comparative Advantage

In economics, comparative advantage refers to the ability of a country or individual to produce a particular good or service at a lower opportunity cost than its competitors.

Taxi Parts

Components or spares used in the maintenance and repair of taxicabs.

Q11: In order to receive $12,000 at the

Q38: Hollifield Corporation is conducting a time-driven activity-based

Q39: Vaden Incorporated makes a single product-a critical

Q56: Mccaskell Corporation's relevant range of activity is

Q69: Gauch Corporation is conducting a time-driven activity-based

Q79: Ploof Corporation is conducting a time-driven activity-based

Q110: Gauch Corporation is conducting a time-driven activity-based

Q120: Chruch Corporation manufactures numerous products, one of

Q149: Hennig Plastics Equipment Corporation has developed a

Q155: Fenderson Incorporated makes a single product--a cooling