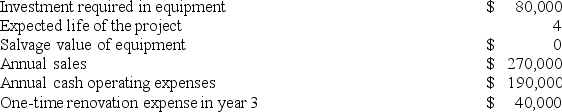

Mesko Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

Use Exhibit 7B-1 to determine the appropriate discount factor(s) using table.

The net present value of the entire project is closest to:

Definitions:

Managerial Decision

The process by which managers choose among alternative strategies or actions to solve organizational problems or to take advantage of opportunities.

NPV

Net Present Value, a method used in capital budgeting to determine the profitability of an investment or project by calculating the present value of expected cash flows versus initial cost.

Independent Projects

Investment opportunities that do not affect the cash flows or profitability of other projects considered by an entity.

Managerial Decision

The process by which management responds to opportunities and threats by analyzing options and making determinations about specific organizational goals and courses of action.

Q2: Rohn Corporation is conducting a time-driven activity-based

Q13: Feauto Manufacturing Corporation has a traditional costing

Q27: Frame Corporation's Maintenance Department provides services to

Q49: Stopyra Incorporated makes a single product-a cooling

Q51: Montecalvo Logistic Solutions Corporation has developed a

Q59: Fredin Incorporated makes a single product-an electrical

Q84: Mongiello Corporation is conducting a time-driven activity-based

Q94: An income statement for Sam's Bookstore for

Q114: In a Cost Analysis report in time-based

Q226: Balerio Corporation's relevant range of activity is