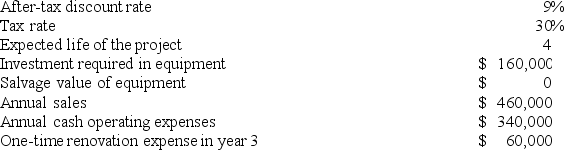

Marbry Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 2 is:

Definitions:

In-house

Referring to activities or operations that are carried out within an organization by its own members or resources, rather than being outsourced.

Outsourcing Arrangements

Agreements where one company hires an external party to perform services or create goods that traditionally were performed in-house.

Cost Savings

Reductions in expenses, achieved through efficiency improvements, negotiation, or eliminating wasteful practices, contributing to an organization's financial health.

Incompetent Outsourcer

A third-party provider that fails to meet the contractual performance standards or expectations in delivering services or products.

Q11: Variable service department costs should be charged

Q11: Pacius Corporation is conducting a time-driven activity-based

Q48: Union Corporation manufactures and sells one product.

Q59: Fredin Incorporated makes a single product-an electrical

Q63: Management of Plascencia Corporation is considering whether

Q76: When a dispute arises over a transfer

Q78: Yau Corporation is considering a capital budgeting

Q109: Lennox Corporation has provided the following information

Q118: At the beginning of last year, Monze

Q284: Adens Corporation's relevant range of activity is