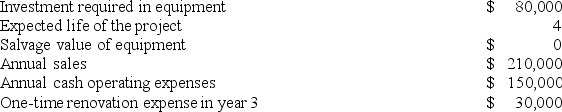

Planas Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The income tax expense in year 3 is:

Definitions:

Outside Order Taker

A sales role focused on receiving and processing orders from customers, typically not responsible for proactive selling or customer acquisition.

Inventory Clerk

A professional responsible for managing and maintaining a company's inventory, including receiving, recording, and distributing materials or products.

Taking Inventory

The process of counting and recording the quantity and condition of items or assets currently held by an organization or individual.

Inside Order Takers

Sales personnel who manage orders and assist customers from within the company, typically in an office setting, rather than in the field.

Q31: Fregozo Products, Inc., has a Connector Division

Q47: Chuong Corporation is conducting a time-driven activity-based

Q57: Schlaefer Corporation is conducting a time-driven activity-based

Q63: Ganus Products, Inc., has a Relay Division

Q82: The management of Landstrom Corporation would like

Q108: Krueger Corporation is conducting a time-driven activity-based

Q138: Stopyra Incorporated makes a single product-a cooling

Q145: Harris Corporation uses a standard cost system

Q160: Songster Corporation applies manufacturing overhead to products

Q167: A furniture manufacturer uses a standard costing