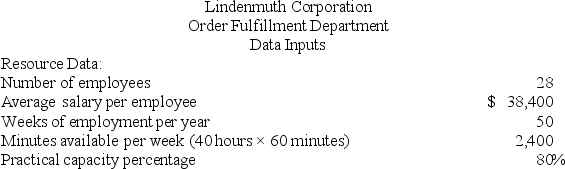

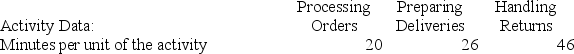

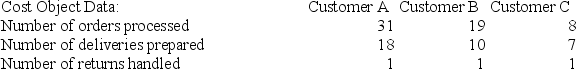

Lindenmuth Corporation is conducting a time-driven activity-based costing study in its Order Fulfillment Department. The company has provided the following data to aid in that study:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer A would be closest to:

On the Customer Cost Analysis report in time-driven activity-based costing, the total cost assigned to Customer A would be closest to:

Definitions:

Contingent Liabilities

Possible obligations that arise from past events and whose existence and amount will be confirmed only by the occurrence or non-occurrence of one or more uncertain future events.

Timing Difference

Timing difference refers to the difference that arises between taxable income and accounting income due to different recognition times of revenue and expenses.

Investment Revenue

Refers to the income earned from investing in assets like stocks, bonds, real estate, or other investment vehicles.

Equity Method

An accounting technique used for recording investments in which the investor has significant influence over the investee but does not control it outright.

Q24: All differences between super-variable costing and variable

Q25: Spillett Corporation is conducting a time-driven activity-based

Q27: Arca Incorporated makes a single product-a critical

Q44: Tierman Incorporated makes a single product-a cooling

Q62: Eaglin Company's quality cost report is to

Q88: Morice Industries Inc. has developed a new

Q88: Layer Corporation has provided the following information

Q94: Bartucci Corporation is conducting a time-driven activity-based

Q94: Morr Logistic Solutions Corporation has developed a

Q125: Condo Corporation has provided the following information