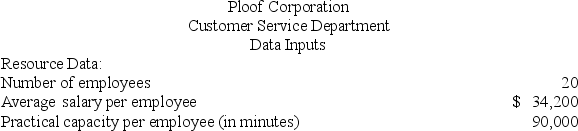

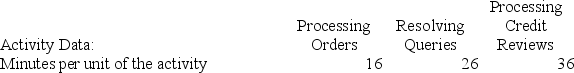

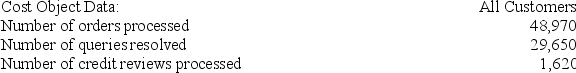

Ploof Corporation is conducting a time-driven activity-based costing study in its Customer Service Department. The company has provided the following data to aid in that study:

On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

On the Capacity Analysis report in time-driven activity-based costing, the "unused capacity in number of employees" would be closest to:

Definitions:

Notes Payable

Financial obligations represented by written promises to pay specified amounts of money at future dates.

Accounts Payable

Liabilities representing amounts owed by a company to suppliers for goods and services purchased on credit.

Journal Entry

A record in the accounting journals that documents a financial transaction.

FICA Taxes

Taxes imposed by the Federal Insurance Contributions Act, funding Social Security and Medicare programs, withheld from employees’ pay and matched by employers.

Q1: Which of the following would be classified

Q13: The R<sup>2</sup> (i.e., R-squared) varies from 0%

Q22: The quality MOST likely to promote thriving

Q23: A mom feels ill at a family

Q36: Which of the following would be classified

Q49: Padmore Corporation has provided the following information

Q51: Montecalvo Logistic Solutions Corporation has developed a

Q54: Wyler Logistic Solutions Corporation has developed a

Q71: Arca Incorporated makes a single product-a critical

Q88: All of the following are true regarding