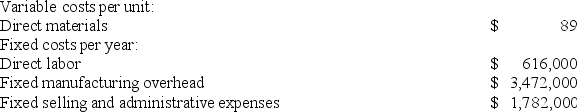

Letcher Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 56,000 units and sold 54,000 units. The company's only product is sold for $227 per unit.

The company is considering using either super-variable costing or an absorption costing system that assigns $11 of direct labor cost and $62 of fixed manufacturing overhead to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

Definitions:

Promissory Note

A financial instrument involving a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

Maker

An individual or entity that creates or issues a financial instrument, such as a check or note, thereby promising to pay the amount stated.

Direct Write-Off Method

An accounting method where uncollectible receivables are directly written off against income at the time they are deemed unrecoverable.

Allowance Method

An accounting technique used to anticipate and adjust for potential uncollectible accounts receivable.

Q3: Which of the following would be classified

Q12: Planas Corporation has provided the following information

Q14: Ladle Corporation uses the absorption costing approach

Q23: The management of Plitt Corporation would like

Q29: Letcher Corporation manufactures and sells one product.

Q55: Callander Corporation is a wholesaler that sells

Q55: Josie's mother tells her that she has

Q78: Weimar Corporation is conducting a time-driven activity-based

Q101: Three risk factors for serious teenage delinquency

Q202: Sexual desire is first triggered by the