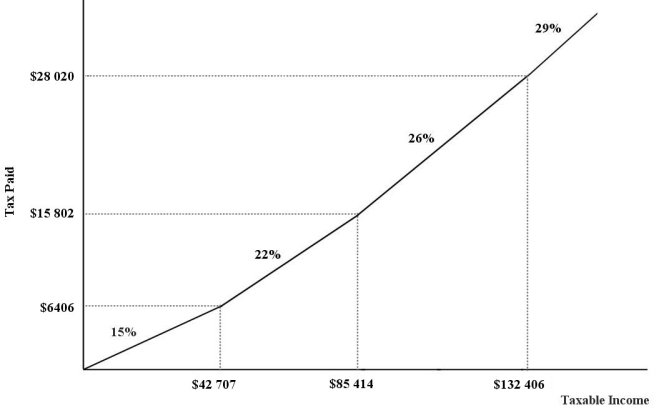

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2.This income- tax system can be characterized as

Definitions:

Financial Incentives

Monetary rewards or penalties intended to motivate particular behaviors or outcomes in individuals or organizations.

Basic Needs

Essential requirements for human survival, such as food, water, shelter, education, and healthcare.

Q8: Economies of scale and product differentiation can

Q22: Refer to Figure 16- 3.Assume there are

Q32: Consumers will bear a larger burden of

Q36: Refer to Figure 34- 4.Assume there is

Q44: The existence of imperfectly competitive firms implies

Q47: For a given commodity,quantity demanded can be

Q63: Refer to Figure 18- 2.An individual with

Q67: Choose the best reason for a rightward

Q77: Suppose a piece of capital equipment offers

Q92: Suppose that a Canadian brewery sells beer