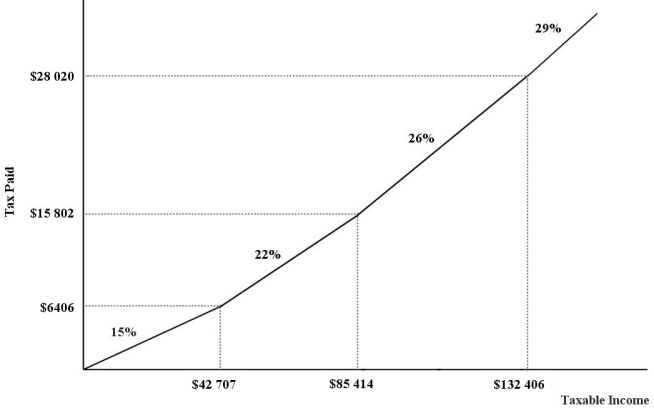

The figure below show a simplified version of the current (2012) Canadian federal income- tax system.The marginal income- tax rates for the four ranges of income are 15.5%,22%,26%,and 29%,respectively.

FIGURE 18- 2

FIGURE 18- 2

-Suppose taxes are levied in the following way.All individuals pay a tax equal to $2000 no matter what income they earn.In addition,all individuals pay 20% of all their earned income in taxes.This income- tax system is

Definitions:

Continual Self-reflection

The ongoing process of introspection and analysis of one's thoughts, actions, and emotions to foster personal growth.

Acquisition Of Skills

The process of learning or gaining new abilities or expertise through practice, study, or experience.

Mode Of Treatment

The method or approach adopted for treating a medical condition, psychological issue, or any health-related problem.

Frequency And Duration

Terms referring to how often an event happens (frequency) and the length of time it occurs (duration).

Q2: A tax that takes a smaller percentage

Q6: The concept of vertical equity is derived

Q9: Economists build models that abstract from the

Q20: If,over a period of a year,a country's

Q24: In general (and in the absence of

Q27: Suppose that Spain is currently producing 90

Q49: The efficient price to charge consumers for

Q55: Refer to Figure 16- 3.Assume there are

Q57: A scientific prediction is<br>A)always based on the

Q91: One possible reason for wage differentials is