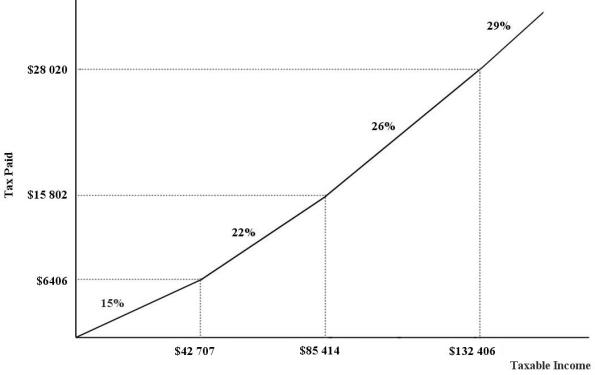

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

Definitions:

Organization Design

The planning and structuring of an organization's framework and systems to align with its goals and strategy, optimizing its operational efficiency.

Internal Factors

Influences originating within a person or organization that affect behaviors, decisions, or operations.

External Factors

Elements outside an individual or organization that can impact its performance or decision-making process.

Network Organization Design

An organizational structure that is more flexible and adaptive, characterized by interconnected nodes or units working together on common projects or goals.

Q10: Consider a remote village with a limited,freely

Q18: To a monopsonist in a labour market,the

Q29: Consider an economy in which existing capital

Q37: Suppose a per-unit tax is imposed on

Q42: From the perspective of individuals,the goods and

Q60: The efficiency argument for government provision of

Q62: Other things being equal,as the price level

Q64: In a perfectly competitive labour market,all workers

Q98: Refer to Figure 18-2.An individual with a

Q105: Private markets will always provide too few