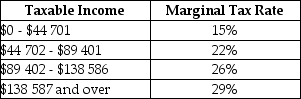

The table below shows 2015 federal income-tax rates in Canada.

TABLE 18-1

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the minimum rate of 15%?

Definitions:

Net Profit

The financial gain or loss a business makes after subtracting all expenses, taxes, and costs from total revenue.

Shadow Price

In linear programming, it refers to the value that represents the change in the optimal objective function value per unit increase in the right-hand side of a constraint.

Finishing Constraint

A limitation or requirement in the production process that must be met before a product can be completed and delivered.

Total Profit

Total profit is the total income of a business after subtracting all expenses.

Q9: Consider an ordinary rivalrous good, provided in

Q26: To compare the economyʹs aggregate output in

Q39: The simple multiplier, which applies to short-run

Q42: When calculating GDP from the expenditure side,

Q46: Possible implications of corporate income taxes being

Q53: During recessions, individual investment in higher education

Q68: Consider the equation: AE = C +

Q74: Consider a small economy with real GDP

Q120: Consider the simplest macro model with demand-determined

Q121: Consider the allocation of a nationʹs resources