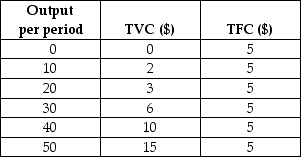

Consider the following total cost schedule for a perfectly competitive firm producing ball-point pens.

TABLE 9-3

TABLE 9-3

-Refer to Table 9-3.As this firm increases output from 40 units to 50 units per period,its marginal cost rises to

Definitions:

Ending merchandise inventory

The final value of goods available for sale at the end of an accounting period, calculated as beginning inventory plus purchases minus cost of goods sold.

Inventory costing method

An accounting methodology used to value inventory and determine the cost of goods sold, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out).

Ending inventory

The value of goods available for sale at the end of an accounting period, a crucial component for calculating the cost of goods sold (COGS).

Earliest costs

This term is not standard in financial terminology; it may refer to historical costs, which are the original monetary value of an economic item.

Q2: An ineffective means of discouraging the entry

Q4: Suppose a production function for a firm

Q13: If there are economic profits in a

Q16: Refer to Figure 12-6. Suppose this firm

Q19: One of the reasons cartels are considered

Q31: Which of the following is an example

Q46: Choose the statement that best compares the

Q60: Refer to Table 9-2. If the firm

Q86: Consider a perfectly competitive labour market for

Q89: In principle, a comparison of the long-run