From inception of operations to December 31, 2010, Harris Corporation provided for uncollectible accounts receivable under the allowance method: Provisions were made monthly at 2 percent of credit sales; bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Harris's usual credit terms are net 30 days.

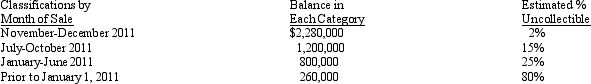

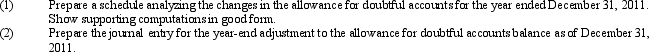

The credit balance in the allowance for doubtful accounts was $260,000 at January 1, 2011. During 2011, credit sales totaled $18,000,000, interim provisions for doubtful accounts were made at 2 percent of credit sales, $180,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $30,000. Harris installed a computer system in November 2011 and an aging of accounts receivable was prepared for the first time as of December 31, 2011. A summary of the aging is as follows:

Based on the review of collectibility of the account balances in the "prior to January 1, 2011" aging category, additional receivables totaling $120,000 were written off as of December 31, 2011. Effective with the year ended December 31, 2011, Harris adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Definitions:

Polyethylene

A polymer made from the polymerization of ethylene, used in a wide array of products, including plastic bags, films, and containers.

Carbon-Carbon Double Bond

A chemical bond between two carbon atoms involving four bonding electrons, making compounds more reactive.

Geometry

The branch of mathematics that deals with the properties and relationships of points, lines, surfaces, and solids.

Alkene

Organic compounds that differ from alkanes by having at least one double bond between carbon atoms, making them unsaturated.

Q11: Which of the following statements is true

Q14: Gekko, Inc. reported the following balances (after

Q14: Net realizable value can be defined as<br>A)

Q23: What is the difference between a promise

Q24: Assume the following facts for Kurt Company:

Q30: Orvis Company reported liabilities totaling $1,230,000 as

Q55: Which of the following is correct regarding

Q56: From inception of operations to December 31,

Q58: The term "comprehensive income" as defined by

Q112: An example of an inventory accounting policy