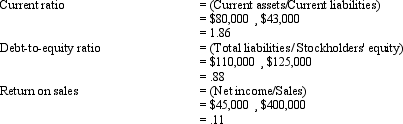

The following 3 ratios have been computed using the financial statements for the year ended December 31, 2011, for CR Company:

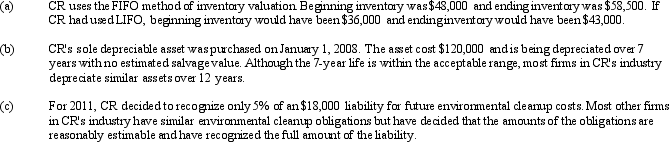

The following additional information has been assembled:

Show how the values for the 3 ratios computed above differ if CR had used LIFO, depreciated the asset over 12 years, and recognized the full amount of its environmental cleanup obligation. Compute how the financial statements would differ if the alternative accounting methods had been used. Do not treat the use of these alternative methods as accounting changes. Ignore any income tax effects.

Definitions:

Component Cost

Component Cost is the rate of return expected by investors on a specific source of financing, such as debt or equity, contributing to the company's overall cost of capital.

WACC

Stands for Weighted Average Cost of Capital, a calculation used to assess the cost of a company's financing including equity and debt.

WACC

The Weighted Average Cost of Capital measures a firm’s cost of capital, weighting each type of capital according to its proportion.

Project Evaluation

Project evaluation involves assessing a project's viability and effectiveness in achieving its objectives, often considering factors like cost, time, and potential returns.

Q2: The following information for Wilbur Company is

Q5: Assume cash paid to suppliers for 2011

Q13: The records of George Company provided the

Q19: International Accounting Standard 8 requires<br>A) a restatement

Q24: The accounts and balances shown below were

Q32: Which of the following typically involves the

Q40: WM is a waste disposal company. Explain

Q56: When computing diluted earnings per share, stock

Q64: A contingent loss should be disclosed in

Q72: All of the following are a component