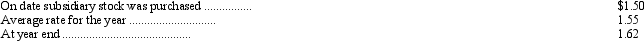

Rome Enterprises, a subsidiary of La Italia Company based in New York, reported the following information at the end of its first year of operations (all in euros) : assets--1,320,000; expenses--340,000; liabilities--880,000; capital stock--80,000, revenues--400,000. Relevant exchange rates are as follows:

As a result of the translation process, what amount is recorded on the financial statements as the translation adjustment?

Definitions:

Uncollectible

Debt or receivables that are considered impossible to collect, potentially due to the debtor's inability to pay.

Budgeted Cash Disbursements

Budgeted cash disbursements are forecasted cash payments during a specific period, part of cash flow planning.

Bad Debts

Accounts receivable that are considered uncollectible and are written off as a loss.

General Operating Expenses

These are the day-to-day expenses necessary for the management and administration of a business, such as rent, utilities, and payroll.

Q13: The following data relate to a construction

Q18: Which of the following is a counterbalancing

Q24: The Supplies on Hand account balance at

Q30: If a company issues both a balance

Q31: Which of the following is an item

Q38: Which of the following tests may be

Q47: Piston Corporation has the following pension information

Q49: Goods on consignment should be included in

Q68: The cost recovery method is<br>A) used only

Q80: Statement of Financial Accounting Concepts No. 1