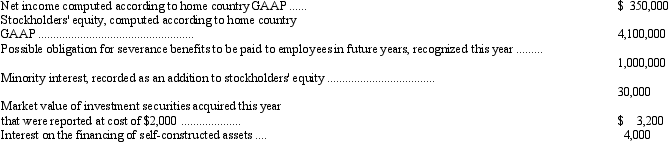

The following financial information is for Olaf Company, a non-U.S. firm with shares listed on a U.S. stock exchange:

If Olaf Company were following U.S. GAAP, the minority interest would have been classified as a liability instead of as part of stockholders' equity. In addition, minority interest income of $3,000 for the year would have been excluded from the computation of net income. Under U.S. GAAP the investment securities would have been classified as trading securities and the interest on financing of self-constructed assets would have been capitalized rather than expensed.

Prepare reconciliations of Olaf's reported stockholders' equity and net income to U.S. GAAP.

Definitions:

Activity-Based Costing

An accounting method that identifies the activities in an organization and assigns the cost of each activity to all products and services according to the actual consumption by each.

Activity-Based Costing

A pricing strategy that pinpoints various tasks within a company and allocates the expense of each task across all goods and services based on their real usage.

Batches

Groups of items or materials processed or produced together in a manufacturing or production process.

Activity-Based Costing

A costing method that assigns overhead and indirect costs to related products and services based on their usage of the resources.

Q1: Certain assets currently are omitted from the

Q1: Which of the following causes a change

Q10: Rome Enterprises, a subsidiary of La Italia

Q11: The following financial information is for Olaf

Q16: Which of the following is a deduction

Q22: All of the following components are shown

Q27: Which of the following is consistent with

Q29: Carbon Company's accounting records provided the following

Q46: The amortization of bond discount related to

Q55: Which of the following is not true