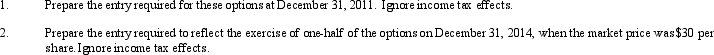

NRE Corporation has a stock option plan for its continuing employees that provides that each qualified employee may receive an option for a specified number of shares of the company's $1 par value stock. Employees must continue working for the company for three years to earn the grants, which may be exercised any time after the three years, at an option price of $10 per share. On January 1, 2011, employees were granted options for 3,000 shares when the market price was $16 per share. The fair value of the options was $24 each. The expected annual forfeiture rate is 5%. The accounting period ends December 31. NRE uses SFAS No. 123R in accounting for these options. Assume that the estimated and actual forfeiture rates are equal.

Required:

Definitions:

Inelastic Demand

A market condition where the demand for a product does not change significantly when its price changes.

Elastic Supply

Describes a situation where the quantity supplied of a good changes significantly when its price changes.

Tax Burden

The measure of the financial charge or impact of taxes on an individual or a corporation.

Excise Tax

A tax on specific goods or services, such as tobacco, alcohol, and gasoline, designed to raise revenue and/or discourage consumption of certain products.

Q5: The bail system goes back to English

Q5: RCM Corporation, a calendar-year firm, is authorized

Q12: Jazz company started construction on a building

Q12: On January 1, 2011, the Delhi Corp.

Q14: If convertible bonds are dilutive, the interest

Q23: A major difference between the Financial Accounting

Q28: Draper Corp. leased a new building and

Q29: Which one of the following items is

Q29: Quest Company began operations five years ago.

Q77: The following information applies to the next