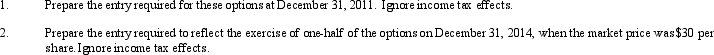

NRE Corporation has a stock option plan for its continuing employees that provides that each qualified employee may receive an option for a specified number of shares of the company's $1 par value stock. Employees must continue working for the company for three years to earn the grants, which may be exercised any time after the three years, at an option price of $10 per share. On January 1, 2011, employees were granted options for 3,000 shares when the market price was $16 per share. The fair value of the options was $24 each. The expected annual forfeiture rate is 5%. The accounting period ends December 31. NRE uses SFAS No. 123R in accounting for these options. Assume that the estimated and actual forfeiture rates are equal.

Required:

Definitions:

Concurrent

Occurring or existing simultaneously or side by side.

Feedforward

A communication process that focuses on providing future-oriented feedback or information to guide actions and improve outcomes before tasks are executed.

Internal Auditing

An objective assurance and consulting activity designed to add value and improve an organization's operations, focusing on internal control effectiveness and risk management.

Accounting Manager

A professional role responsible for overseeing accounting and financial tasks within an organization, such as maintaining financial records, preparing reports, and ensuring compliance with laws and regulations.

Q16: Which of the following is an example

Q22: On September 1, 2011, Steelers Corporation declared

Q50: Accounting for inventories by applying the lower-of-cost-or-market

Q60: Which of the following does not meet

Q66: On December 31, 2009, Jamfest Travel Inc.

Q66: Police officers cannot perform a warrantless search

Q73: Washington Corporation provides an incentive compensation plan

Q76: When an entity reduces its interest in

Q79: In January, Hunter Corporation entered into a

Q86: Proper application of accounting principles is most