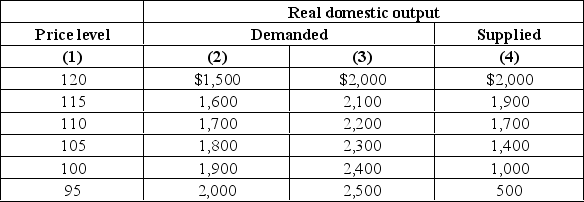

In the table below are aggregate demand and aggregate supply schedules.  (a) Suppose in Year 1, aggregate demand is shown in columns (1) and (2) in the above table and short-run aggregate supply is shown in columns (1) and (4) in the above table.What will be the equilibrium level of real GDP and the equilibrium price level?

(a) Suppose in Year 1, aggregate demand is shown in columns (1) and (2) in the above table and short-run aggregate supply is shown in columns (1) and (4) in the above table.What will be the equilibrium level of real GDP and the equilibrium price level?

(b) Suppose in Year 2, aggregate demand changes and is now shown in columns (1) and (3).What will be the new equilibrium level of real GDP and the new equilibrium price level?

(c) Suppose in Year 3, aggregate demand changes and is now shown again in columns (1) and (2).What will be the new level of real GDP and the new price level if prices and wages are completely flexible downward?

(d) Suppose in Year 3, aggregate demand changes and is now shown again in columns (1) and (2).What will be the new level of real GDP and the new price level if prices and wages are completely inflexible downward?

Definitions:

Unemployment Tax Payments

Taxes paid by employers to fund state unemployment insurance programs, helping to provide benefits to unemployed workers.

Under-Withheld

A situation where not enough taxes have been taken out of an individual's paycheck, leading to a potential tax bill.

Supplemental Payments

Extra payments received in addition to regular income, such as bonuses or overtime pay, which can affect a taxpayer's AGI.

Self-Employment Taxes

Taxes paid by self-employed individuals, covering Social Security and Medicare taxes, based on net earnings from self-employment.

Q1: Explain the Phillips Curve concept and construct

Q6: List two concerns with inflation.

Q11: "The increasing importance of durable goods has

Q15: The following table shows the domestic quantity

Q15: What are the two significant characteristics of

Q28: Arrange the following items in the form

Q36: Explain the difference between real and nominal

Q44: Describe in words how one can recognize

Q49: How does the public debt contribute to

Q127: The law of increasing opportunity costs is