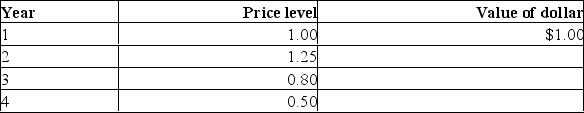

Refer to the above information.The value of the dollar in year 2 is:

Refer to the above information.The value of the dollar in year 2 is:

Definitions:

Price-Earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to evaluate if a stock is over or under-valued.

Earnings Per Share

The amount of earnings a company makes, divided by its outstanding common shares, which reveals the firm's level of profitability.

Return on Assets

A financial ratio indicating the profitability of a company relative to its total assets, measuring how effectively a company uses its assets to generate earnings.

Debt-Equity Ratio

The indicator that quantifies how much of a company's assets are financed through equity and how much through debt.

Q50: Which of the factors below best explain

Q52: Actual cash reserves equal desired reserves plus

Q54: In an aggregate demand-aggregate supply diagram, equal

Q87: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6686/.jpg" alt=" Refer to the

Q101: The following table shows the aggregate demand

Q148: Refer to the market for money diagram

Q151: Actual deficits are:<br>A)Generally smaller than actual deficits<br>B)Generally

Q154: If the Bank of Canada buys government

Q164: When the market for money is in

Q166: Bond prices and interest rates are directly