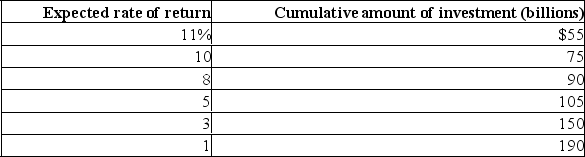

Use the following data to answer the questions.  (a) Explain why this table is essentially an investment demand schedule.(b) If the interest rate was 8%, how much investment would be undertaken?

(a) Explain why this table is essentially an investment demand schedule.(b) If the interest rate was 8%, how much investment would be undertaken?

(c) Why is there an inverse relationship between the rate of interest and the amount of investment?

Definitions:

Dividends Paid

Disbursements from a company's earnings given to its shareholders, commonly known as profit sharing.

External Financing

Funds a business obtains from outside sources, such as loans, investments, or grants, to support its operations or growth.

Dividend Payout Ratio

A financial metric that shows the percentage of a company's earnings paid to shareholders as dividends, reflecting the company's dividend policy and financial health.

Maximum Rate of Growth

The highest possible expansion rate that a business can achieve without obtaining additional financing from external sources.

Q4: What happens to the money supply when

Q6: Answer the next question based on the

Q8: Give an equation that shows the relationship

Q10: Assume that a firm can produce product

Q11: The value of a college education has

Q18: The World Bank defines extreme poverty as

Q37: Why does the inclusion of a lump-sum

Q46: Explain why exports are added to, and

Q59: Describe the adjustments in the production possibilities

Q70: Based on Kingsley Davis and Wilbert E.