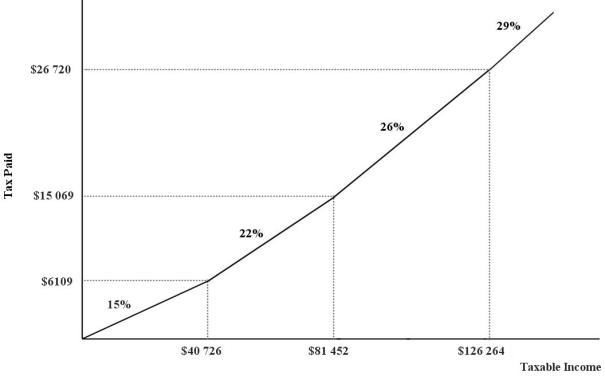

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. What must be true of the four marginal income- tax rates in order for the tax to be considered a "flat" tax?

Definitions:

Pull Strategy

A supply chain strategy in which customer orders drive manufacturing and distribution operations.

Transportation Management

The process of planning, executing, and optimizing the movement of goods and materials from their point of origin to their final destination.

Distribution Activities

Processes involved in making a product or service available for use or consumption by end-users or consumers through a distribution channel.

Marketing Chain

The sequence of processes involved in the production and distribution of a product or service, which may include suppliers, manufacturers, and retailers, aimed at delivering value to the consumer.

Q17: Consider a manufacturing firm that contemplates buying

Q18: Private and competitive markets could produce efficient

Q21: A country with a domestic market is

Q59: Refer to Figure 3- 4. If the

Q84: Suppose five countries in Central America agree

Q84: Canada is both an importer and an

Q91: Profit- motivated product and process innovation is

Q92: An example of a public good is<br>A)

Q101: Refer to Figure 18- 2. What needs

Q122: The marginal revenue product curve for a