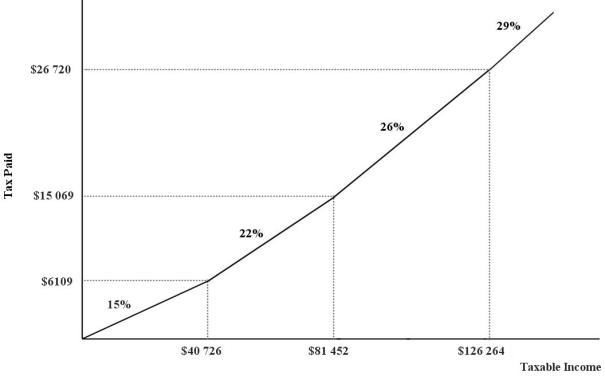

The figure below shows a simplified version of the current Canadian federal income- tax system. The marginal income- tax rates for the four ranges of income are 15 percent, 22 percent, 26 percent, and 29 percent, respectively.  FIGURE 18- 2

FIGURE 18- 2

-Refer to Figure 18- 2. What must be true of the four marginal income- tax rates in order for the tax to be considered a "flat" tax?

Definitions:

SWOT Analysis

SWOT Analysis is a strategic planning tool used to identify an organization's Strengths, Weaknesses, Opportunities, and Threats.

Gantt Chart

A visual tool used for project management, showing activities or tasks plotted against time, often used to monitor progress.

Pert Chart

A project management tool that outlines the tasks involved in a project, their sequence, and the time required for each, facilitating the identification of the critical path for project completion.

Market Development

The process of expanding into new markets or segments to increase the reach and sales potential of a company's products or services.

Q6: A paper mill discharges chemicals into a

Q19: Refer to Figure 18- 2. What must

Q37: The concept of vertical equity is derived

Q39: Refer to Figure 16- 4. What is

Q47: An economist has data showing Canadian GDP

Q54: Refer to Table 15- 2. If the

Q63: Consider the following statement: "Canada is unambiguously

Q63: Refer to Figure 16- 4. Suppose the

Q94: The aggregate emission- reduction targets of the

Q99: On a coordinate graph, what is the