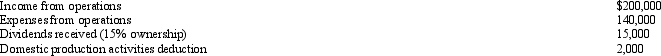

During the current year,Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

On October 1,Kingbird Corporation made a contribution to a qualified charitable organization of $9,000 in cash (not included in any of the above items) .Determine Kingbird's charitable contribution deduction for the current year.

Definitions:

Domestic Suppliers

Businesses or individuals that produce and provide goods or services within the same country they operate.

Tax Revenue

The funds governments receive as a result of taxation.

Tariff

A tax imposed by a government on goods and services imported from other countries, used to restrict trade by increasing the price of imported goods and services.

Quota

A government-imposed trade restriction limiting the number or monetary value of goods that can be imported or exported during a particular period.

Q14: Robert entertains several of his key clients

Q33: Can related parties take advantage of the

Q41: Hans purchased a new passenger automobile on

Q47: A hobby activity can result in all

Q60: Emily is in the 35% marginal tax

Q64: Nikeya sells land (adjusted basis of $120,000)to

Q71: In order to qualify for like-kind exchange

Q77: Taylor inherited 100 acres of land on

Q97: Two-thirds of treble damage payments under the

Q101: What is the difference between the depreciation