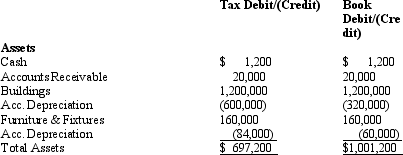

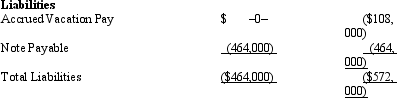

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

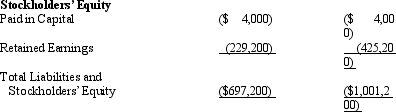

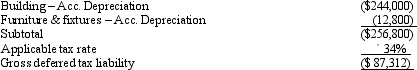

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the journal entry to record Amelia's current tax expense.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Provide the journal entry to record Amelia's current tax expense.

Definitions:

STP Analysis

A marketing approach involving segmentation, targeting, and positioning to tailor marketing strategies to specific audiences.

Resource Allocation

The process of distributing available resources among various projects or departments within an organization to maximize efficiency and achieve goals.

Strategies

Plans or methods devised to achieve a particular goal or to deal with specific challenges and opportunities.

Marketing Plan

A comprehensive document or blueprint that outlines a company's advertising and marketing efforts for the future.

Q4: Margaret owns land that appreciates at the

Q17: Which of these is not a correct

Q57: The AMT tax rate for a C

Q73: In the "rate reconciliation" of GAAP tax

Q85: The § 469 passive activity loss rules

Q97: Two-thirds of treble damage payments under the

Q98: Which of the following legal expenses are

Q101: Katrina,age 16,is claimed as a dependent by

Q115: The exclusion of interest on educational savings

Q160: Under the income tax formula,a taxpayer must