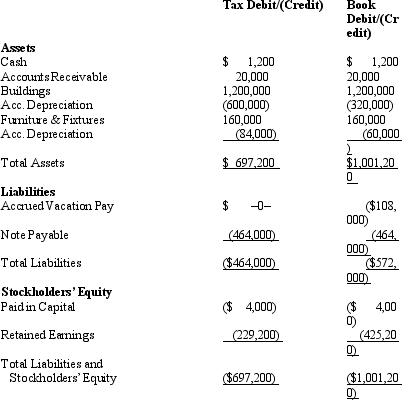

Amelia,Inc.,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

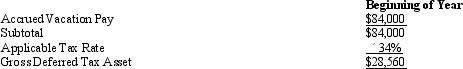

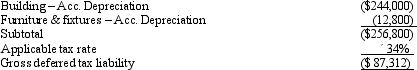

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.What is Amelia's total provision for income tax expense reported on its financial statement and its book net income after tax?

Amelia,Inc.'s,book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.What is Amelia's total provision for income tax expense reported on its financial statement and its book net income after tax?

Definitions:

Variable Costs

Costs that vary directly with the level of output, such as raw materials and direct labor expenses.

Labor

The human effort, either physical or mental, employed in the production of goods and services.

Materials

Raw elements or substances used in the production or manufacturing of goods.

Variable Costs

Costs that change in proportion to the level of output or activity.

Q54: A deferred tax liability represents a potential

Q54: Which of the following sources has the

Q71: The maximum child tax credit under current

Q91: Discuss the logic for mandatory deferral of

Q108: Jessica is a cash basis taxpayer.When Jessica

Q111: Vail owns interests in a beauty salon,a

Q121: White Company acquires a new machine (seven-year

Q147: During 2013,Esther had the following transactions: <img

Q156: A child who has unearned income of

Q167: Discuss the beneficial tax consequences of an