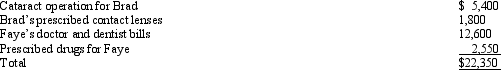

Brad,who would otherwise qualify as Faye's dependent,had gross income of $9,000 during the year.Faye,who had AGI of $120,000,paid the following medical expenses in 2013:  Assuming Faye is age 45,she has a medical expense deduction of:

Assuming Faye is age 45,she has a medical expense deduction of:

Definitions:

Massachusetts

A state in the northeastern United States, significant for being one of the original thirteen colonies and a site of early European settlement, and later, important historical events such as the Boston Tea Party and the American Revolution.

Empire Of Liberty

The idea, expressed by Jefferson, that the United States would not rule its new territories as colonies, but rather would eventually admit them as full member states.

Western Territories

Regions in the western part of the United States or other countries that are not yet fully incorporated into the main political structure.

Political Equals

Political equals refer to individuals or entities possessing the same rights and responsibilities within a political system, emphasizing equality before the law and in the democratic process.

Q26: The profits of a business owned by

Q28: The purpose of the tax credit for

Q29: Contributions to a Roth IRA can be

Q49: Under the terms of a divorce agreement,Ron

Q53: After personal property is fully depreciated for

Q54: The special allocation opportunities that are available

Q56: Jogg,Inc.,earns book net income before tax of

Q104: Which of the following characteristics correctly describes

Q143: Wilma,age 70 and single,is claimed as a

Q156: A child who has unearned income of