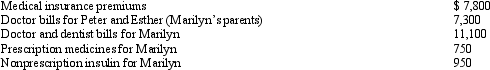

Marilyn,age 38,is employed as an architect.For calendar year 2013,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2013 and received the reimbursement in January 2014.What is Marilyn's maximum allowable medical expense deduction for 2013?

Definitions:

Days' Sales

A measure of how quickly a company can convert its inventory into sales, often used to assess liquidity and operational efficiency.

Inventory Management

The practice of overseeing and controlling the ordering, storage, and use of components that a company will use in the production of items it will sell, as well as overseeing and controlling quantities of finished products for sale.

Merchandise Inventory

The total value of a company's goods that are ready for sale at any given time, including both finished goods and goods in various stages of production.

Consigned Goods

Items that are sent by their manufacturer to a third party, but still remain the property of the manufacturer until sold.

Q3: Federal taxable income is used as the

Q18: Daisy,Inc.,has taxable income of $850,000 during 2013,its

Q20: Compare Revenue Rulings with Revenue Procedures.

Q29: Which item does not appear on Schedule

Q56: Jordan performs services for Ryan.Which,if any,of the

Q104: James,a cash basis taxpayer,received the following compensation

Q111: Trolette contributes property with an adjusted basis

Q113: Child and dependent care expenses include amounts

Q145: In 2006,Ross,who is single,purchased a personal residence

Q168: Frank established a Roth IRA at age