Multiple Choice

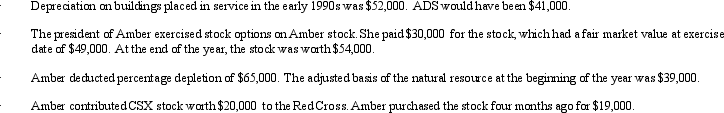

Amber,Inc.,has taxable income of $212,000.In addition,Amber accumulates the following information which may affect its AMT.  What is Amber's AMTI?

What is Amber's AMTI?

Definitions:

Related Questions

Q14: Carol,a citizen and resident of Adagio,reports gross

Q30: The carryover period for the NOLs of

Q42: How can double taxation be avoided or

Q51: What are Treasury Department Regulations?

Q55: Kipp,a U.S.shareholder under the CFC provisions,owns 40%

Q61: Some _ taxation rules apply to an

Q81: In 2013,Ed is 66 and single.If he

Q100: Katelyn is divorced and maintains a household

Q106: USCo,a U.S.corporation,reports worldwide taxable income of $1,500,000,including

Q156: A child who has unearned income of