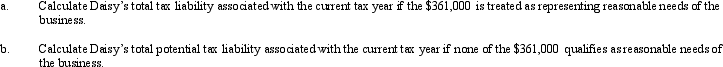

Daisy,Inc.,has taxable income of $850,000 during 2013,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e.,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Definitions:

Contribution Margin

The difference between the sales revenue of a company and its variable costs, indicating how much contributes to covering its fixed costs and generating profit.

Sales Volume

The total quantity of sales or units sold within a particular time frame.

Break-Even Point

The point at which total costs equal total revenues, meaning the business is not making a profit or a loss.

Direct Material

Raw materials that can be physically and directly associated with the finished product during the manufacturing process.

Q23: Which,if any,of the following is subject to

Q27: A corporation may alternate between S corporation

Q42: Alexis (a CPA)sold her public accounting practice

Q46: Mauve Company permits employees to occasionally use

Q66: Section 482 is used by the Treasury

Q69: In determining the filing requirement based on

Q73: Palmer contributes property with a fair market

Q90: What special adjustment is required in calculating

Q115: In connection with the office in the

Q132: Ashley earns a salary of $55,000,has capital