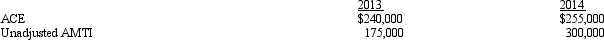

Duck,Inc.,is a C corporation that is not eligible for the small business exception to the AMT.Its adjusted current earnings (ACE)and unadjusted alternative minimum taxable income (unadjusted AMTI)for 2013 and 2014 are as follows:

Calculate the amount of the ACE adjustment for 2013 and 2014.

Calculate the amount of the ACE adjustment for 2013 and 2014.

Definitions:

Breach of Confidence

The unauthorized use or disclosure of confidential information that has been communicated in confidence.

Computer Software

Programs and other operating information used by a computer to perform specific tasks.

Confidential Information

Private information, the disclosure of which would be injurious to a business; a type of intellectual property.

Punitive Damages

Punitive damages are awarded in civil lawsuits as a punishment to the defendant and deterrent to others, over and above compensatory damages.

Q4: Roger owns 40% of the stock of

Q23: Clara,age 68,claims head of household filing status.If

Q27: A corporation may alternate between S corporation

Q35: In November 2013,Katie incurs unreimbursed moving expenses

Q44: If an activity involves horses,a profit in

Q68: A moving expense deduction is allowed even

Q71: If the cost of a building constructed

Q87: Ellen,age 12,lives in the same household with

Q100: U.S.income tax treaties typically:<br>A)Provide for taxation exclusively

Q140: Aiden performs services for Lucas.Which,if any,of the