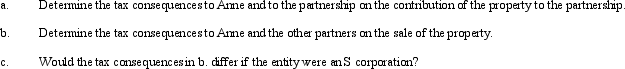

Anne contributes property to the TCA Partnership which was formed 8 years ago by Clark and Tara.Anne's basis for the property is $90,000 and the fair market value is $220,000.Anne receives a 25% interest for her contribution.Because the TCA Partnership is unsuccessful in having the property rezoned from agricultural to commercial,it sells the property 14 months later for $225,000.

Definitions:

Fixed Costs

Expenses that do not change with the level of production or sales volumes, remaining constant regardless of the company's activity levels.

Margin Of Safety

The difference between actual sales and the break-even point. It measures how much sales can fall before a business incurs a loss.

Variable Costs

Expenditures that adjust based on the degree of operational activity or the volume of goods manufactured.

Fixed Costs

Fixed costs are business expenses that remain constant regardless of the level of production or sales activities.

Q2: Kirby,the sole shareholder of Falcon,Inc.,leases a building

Q11: What is the relationship between the regular

Q34: An S corporation that has total assets

Q38: For tax purposes,married persons filing separate returns

Q63: Janet,who lives and works in Newark,travels to

Q76: C corporations and their shareholders are subject

Q87: A limited liability company (LLC)is a hybrid

Q109: Arnold purchases a building for $750,000 which

Q114: A typical state taxable income subtraction modification

Q150: When contributions are made to a traditional