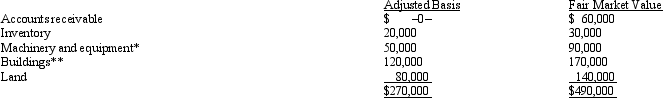

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

School-aged Children

Children in the age range typically associated with attending primary and early secondary education, usually from 6 to 12 years old.

Diagnosed

The process of identifying a disease, condition, or syndrome based on its symptoms and diagnostic tests.

Percentage

A mathematical term that represents a number or ratio expressed as a fraction of 100.

ADHD

Attention Deficit Hyperactivity Disorder, a neurodevelopmental disorder characterized by inattention, impulsiveness, and hyperactivity.

Q2: Amber is in the process this year

Q17: Which of the following is not relevant

Q22: A taxpayer may not appeal a case

Q36: AMT adjustments can be positive or negative,whereas

Q37: Estela,Inc.,a calendar year S corporation,incurred the following

Q43: If lease rental payments to a noncorporate

Q61: Flip Corporation operates in two states,as

Q80: During 2013,Marvin had the following transactions: <img

Q100: U.S.income tax treaties typically:<br>A)Provide for taxation exclusively

Q142: Lily went from her office in Portland